Gold or Silver: Which Is Better for Long-Term Investors?

Investing in precious metals has long been a popular strategy for those looking to preserve wealth, hedge against inflation, and diversify portfolios. Among the most widely considered metals are gold and silver. While both provide a hedge against economic uncertainty, they behave differently over time, have distinct market characteristics, and suit different investor goals. Understanding the nuances between the two is critical for anyone planning a long-term investment strategy.

This article explores the differences between gold and silver, discusses when each may be preferable, and provides insights into historical returns and portfolio strategies.

Gold vs Silver: Key Differences

| Feature | Gold | Silver |

|---|---|---|

| Volatility | Low to moderate | High |

| Safe-haven asset | Strong | Moderate |

| Industrial demand | Low | High |

| Long-term growth potential | Moderate | High during commodity booms |

| Liquidity | Very high | High, but less than gold |

| Storage efficiency | Compact | Bulkier, higher storage costs |

Volatility and Risk

Volatility measures the degree to which a metal’s price fluctuates over time. Gold has historically been more stable, with a standard deviation of annual returns around 15–17%. Silver, in contrast, is more volatile, with standard deviation ranging between 25–30%.

The higher volatility of silver means it can provide greater upside potential, but also higher downside risk. Conservative investors often prefer gold, while aggressive investors seeking higher returns may allocate more to silver.

Safe-Haven Properties

Gold is widely regarded as the ultimate safe-haven asset. It maintains value during economic downturns, financial crises, and periods of high inflation. Central banks worldwide hold gold as part of their reserves, enhancing its stability.

Silver also provides some hedge capabilities, but because of its significant industrial demand, its price is more sensitive to economic cycles. This means silver can fall more sharply than gold during market downturns.

Industrial Demand and Growth Potential

- Silver: Used in electronics, solar panels, medical devices, and other industries. Industrial demand drives higher price growth during economic expansion or commodity booms.

- Gold: Primarily a store of value, less affected by industrial demand. Growth is steadier but lower during commodity bull markets.

Historical Performance

For example, a $10,000 investment in gold 50 years ago at an average annual growth rate of 7.5% would be worth approximately $371,000 today. A similar $10,000 investment in silver at 6.5% growth would be worth roughly $235,000.

These figures highlight gold’s stability and wealth-preserving properties, whereas silver offers higher potential growth with more price fluctuation.

For hands-on analysis, you can calculate potential returns using these tools:

- 50-Year Gold Investment Projection

- 50-Year Silver Investment Projection

When Gold Makes More Sense

- Stability and wealth preservation: Retains value during crises and hedges inflation.

- Low volatility exposure: Price swings are smaller than silver.

- Portfolio diversification: Balances equity-heavy or bond-heavy portfolios.

Gold is particularly suitable for conservative investors or those nearing retirement who want to safeguard wealth.

When Silver May Outperform

- Commodity booms: Silver often rises faster than gold during bull markets.

- Industrial growth cycles: Demand from technology and renewable energy sectors can drive higher prices.

- High-risk, high-reward strategies: Volatility offers higher upside potential for aggressive investors.

Portfolio Allocation: Gold vs Silver

| Investor Type | Gold Allocation | Silver Allocation |

|---|---|---|

| Conservative | 10–15% | 2–5% |

| Balanced | 10–20% | 5–10% |

| Aggressive | 20%+ | 10–15% |

A mix of both metals can enhance portfolio diversification, reduce volatility, and provide exposure to both stability (gold) and growth potential (silver).

Liquidity and Market Considerations

- Gold: Highly liquid, tight bid-ask spreads, easy to sell in large quantities.

- Silver: Liquid but less so than gold, with wider spreads and bulkier storage requirements.

Market capitalization difference: Gold ~$13–15 trillion, Silver ~$1–1.5 trillion, which also contributes to liquidity advantages for gold.

Taxation and Storage

- Both metals are treated as collectibles in the U.S.

- Long-term capital gains: Up to 28% for physical holdings

- Short-term gains: Taxed at ordinary income rates (up to 37%)

- ETFs: Taxed similarly, but easier to trade and store

- Storage: Gold is compact and cheaper to store; silver is bulkier and higher cost per value unit

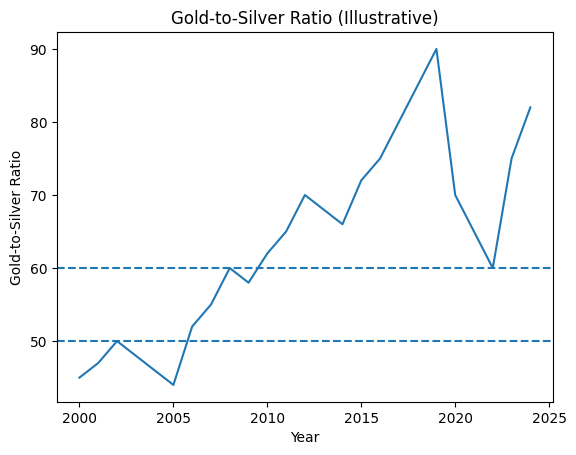

The Gold-to-Silver Ratio

The gold-to-silver ratio measures how many ounces of silver equal one ounce of gold. Historically, it averages 40–60 but can spike during economic stress. Investors use it to:

- Identify buying opportunities when silver is undervalued

- Balance portfolio allocations

- Time purchases or sales for maximum return

Conclusion

Both gold and silver have distinct advantages for long-term investors:

- Gold: Stable, liquid, safe-haven, low volatility — ideal for wealth preservation

- Silver: Higher growth potential, industrial demand, higher volatility — suitable for growth-focused strategies

A balanced portfolio combining both metals can provide stability, diversification, and upside potential. Investors should consider historical performance, risk tolerance, tax implications, and market conditions when determining gold vs silver allocations.

Related:

About the Author

I am a software developer focused on building financial modeling tools and investment simulations that help long-term investors understand compounding, market cycles, and portfolio behavior.

I created PortfolioCalc to explore how contribution timing, return sequences, and different asset classes impact long-term wealth outcomes. The calculators and examples on this site are based on quantitative modeling and scenario analysis.

In addition to developing these tools, I personally invest in diversified ETFs, gold, and Bitcoin using a long-term, data-driven approach. While I am not a licensed financial advisor, the content on this site is designed to translate financial mathematics into practical, educational insights.